Healthcare in France: the Basics

HEALTHCARE:

Registering and using France’s dual system

France has a very high standard of healthcare and is frequently voted at the top of the world’s best systems. Healthcare in France is based on a dual system, comprising the state health insurance, l’Assurance Maladie, and a private insurance ‘top up’ which is provided by private companies and mutual bodies.

Please keep in mind that, in January 2016, the Protection Maladie Universelle system (PUMA) has replaced France’s previous Couverture Maladie Universelle (CMU) arrangement.

For people who are working or running a business in France, registering for healthcare is fairly straightforward. As far as retirees are concerned, there may be a little more paperwork and documentation required as it’s necessary to prove that the resident is in receipt of a pension from another country.

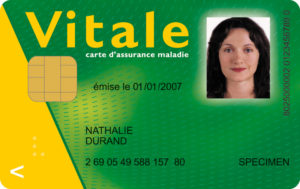

French Carte Vitale Photo by CNAMTS GIE SESAM via CC 30 Wikimedia

The first port of call is to register with l’Assurance Maladie and obtain the ‘open sesame’ document, the Carte Vitale. Make an appointment to visit the local office of the Caisse Primaire d’Assurance Maladie (CPAM) to submit the paperwork required to process your Carte Vitale application.

Once your application has been approved, it could take up to five weeks for your rights to show as ‘active’ so it’s advisable to start the process ahead of time to compensate for this period, or secure private health insurance to cover the time gap. It will take another four weeks or so for the actual Carte Vitale to arrive, but in the meantime you can access your ‘active’ healthcare rights by presenting a copy of the ‘attestation’ letter provided by CPAM.

IN PRACTICE…

With the Carte Vitale, you need to designate a ‘primary physician’ in order to obtain the full level of reimbursement. When you visit the doctor, you present your Carte Vitale and the amount of the state reimbursement is then credited back to your bank account directly. For most routine treatments the state only reimburses around 70% of the cost – and sometimes much less for certain medications and services, depending on the medical necessity and effectiveness of the treatment or prescription in question. Therefore, it’s common for residents to top up their health cover with additional private health insurance, to provide the percentage of fees which aren’t covered by the state.

However, in some instances of long-term illness, called Affections de Longue Durée (ALD), the state can agree to cover 100% of all charges for the duration of the treatment.

The plans offered by complementary ‘top-up’ insurers vary greatly. Some supplementary insurance policies won’t cover treatments or medications which aren’t normally covered by the state health insurance. Others won’t cover surplus charges over and above the official treatment tariff established by the state, and some plans offer extra coverage, such as some optical and dental reimbursements. It’s important to shop around and check that the policy covers a level of service that you’re comfortable with.

For further information, please visit the Healthcare Zone >>

Share to: Facebook Twitter LinkedIn Email

By FrenchEntrée

Leave a reply

Your email address will not be published. Required fields are marked *