French ‘Mutuelles’ (Top-Up Health Insurance): What You Need to Know

Essential Reading

Once you’ve registered for France’s healthcare system and received your Carte Vitale, the next step is to take out a top-up health insurance, known as a ‘mutuelle’. Here’s what you need to know about French mutuelles.

What Is a Mutuelle in France and Why Do You Need One?

Healthcare in France is heavily subsidised by the state, which is one of the reasons why taxes are higher in France than in many other countries and is worth 25% of the wealth of France. It pays out over 470 million euros every year for healthcare costs.

All legal residents and workers in France are covered by the state’s Protection Universelle Maladie (PUMA), taken care of by L’Assurance Maladie or Ameli.fr. This covers all essential and emergency treatments.

You will find, however, that you will still be asked to pay for doctors’ visits, dentists, and many other services, including many prescription medicines. Having presented your Carte Vitale at the appointment, a percentage of this will be automatically reimbursed to you by L’Assurance Maladie. You can see a list of the state reimbursements here, but for example, a doctor’s visit in 2021 costs €25, which is payable by the patient at the time of the appointment. L’Assurance Maladie will then reimburse 70% of this cost – £17.50, leaving you (or your Mutuelle) to pay the remaining €6.50. A hospitalisation at any state or private hospital is reimbursed at a rate of 80%. The remaining percentage is payable by you.

You can read more about the PUMA state health insurance and what it covers (and most importantly, doesn’t cover) here.

If you would like to be reimbursed for more of your costs and receive many treatments and prescription medicines for free, then you will need to sign up for complimentary health insurance, known as a mutuelle. This ‘top-up’ insurance will pay the remaining percentage (or a portion of it), depending on the type of policy that you take out. You should also note that for all appointments with doctors or specialists (not including dentists and opticians), you will be charged a flat-rate ‘participation fee’ (participation forfaitaire) of €1. This is not refunded by the state or covered by mutuelles, but there are exemptions for pregnant women, under 18s, and those receiving CMU ou l’Aide Médicale de l’Etat state support.

Do I Need a French Mutuelle?

All salaried workers in France are legally required to have a mutuelle health insurance, of which a minimum of 50% is payable by your employer (although many jobs include full health coverage and even family plans). Self-employed workers may also find they are required to take out top-up insurance—it’s a legal requirement for becoming a micro-entrepreneur or setting up a business.

If you are not working in France, you may choose not to take out a mutuelle, but if you have particular health conditions, regularly see a doctor, or just want to protect yourself in the event of an accident or illness, it is highly recommended.

What Do I Need to Take Out a Mutuelle?

You must be resident in France to take out a mutuelle health insurance policy, and you must be registered in the state healthcare system. As a foreign citizen resident in France, you will be required to present your passport, your residency card or visa (titre de séjour), and either proof of your work status (a tax return or avis d’imposition, a work contract, or payslips) or proof of 6 months’ residence in France (rental receipts or quittances de loyer, electricity bills, or a signed attestation from the homeowner you are staying with).

Pre-existing conditions

An important thing to note about France’s mutuelle health insurers (les mutuelles de santé) is that they are bound by the ‘code de la mutualité’. This means that they are bound by a non-discriminatory code of practice, meaning that they cannot refuse health coverage or charge extra premiums based on health conditions or to perceived high-risk individuals.

However, remember that the coverage you receive will be dependent on the type of policy you take out, and costs will vary accordingly (more about that in a moment).

How Does a French Mutuelle Work?

Mutuelles de santé can only be offered by mutuelle health insurers (les mutuelles de santé), which are non-profit cooperative insurance bodies owned by their policyholders.

The concept of the mutuelle actually began way back in French history before the Revolution, but they were only developed in earnest into large organisations after the Second World War in an effort to give better protection and care to the population. There is a very rich history of conflict and liberty around the ideology and organisation of them, which you can read here if you understand French.

Note that while you may also see mutuelles offering a range of different insurance policies such as home insurance or car insurance, these are different from ‘les mutuelles de santé‘, which provide only health insurance. These mutuelles d’assurances operate in a similar way but are bound by the ‘code des assurances’ instead, so they do not provide the same unconditional coverage.

Using Your Mutuelle Health Insurance

When you take out a mutuelle insurance policy, you will pay a monthly fee, which ranges between €27 to €100+, depending on your age and requirements (there are up to 8 different brackets of care with some mutuelles). At the end of each month, you will get a letter or online statement detailing any reimbursements.

Tiers Payant: How it Works

Most mutuelles offer coverage on a tiers payant system, which means you will get a mutuelle card or tiers payant card that includes the details of your policy and coverage. Each time you visit a doctor, cabinet, clinique, or pharmacy, you will be asked for this card, in addition to your Carte Vitale, and the costs will be covered directly by your mutuelle (without you having to pay upfront). In cases where you have to pay the €1 participation forfaitaire, this will automatically be deducted from your mutuelle account (you won’t be asked to pay the €1).

There are still occasions (including doctors appointments), where you will need to pay upfront, and the amount payable by your mutuelle will be automatically reimbursed to you. Sometimes you will also need to pay upfront or will be sent a bill to pay, and will then need to take the receipt of payment to your mutuelle to request a reimbursement (most mutuelles now allow you to do this online).

Which Mutuelle Should You Choose?

There are many different mutuelles available, and it is a competitive market, so it’s a good idea to shop around and find the best one for your individual needs.

The most important things to consider when choosing a mutuelle are:

- The policies available and coverage you receive (more about that below): these can vary greatly between insurers, so be sure you understand exactly what is and isn’t covered.

- The cost of the policy: again, these will vary depending on the insurer and the policy you choose.

- Which medical establishments accept the mutuelle: not all establishments accept all mutuelles, which can be very frustrating, so it’s worth doing a bit of extra research.

Some of the most popular mutuelles, which tend to be accepted by most esbliashements are the following, but this is by no means a definitive list:

Which Mutuelle Policy Should You Choose?

The most important thing when deciding on a mutuelle will be the policy that you take out and what coverage it offers. Firstly, as top-up insurance is a complimentary service, you can only be reimbursed for things that the securité sociale reimburses parts of too: they no longer work as separate services.

However, different mutuelles will still offer different sums of money for different services. For example, some mutuelles will give you €400 towards buying new glasses, whilst others only €120. So, you need to be very clear on what your needs are when you go around asking for a ‘devis’ (quote) during your mutuelle search. Some offer good rates for dentists; others don’t. Mutuelles typically cover days spent in hospital and nurses who have to come to your house, but there is a whole host of complementary medical services, which may be included for free, or you may pay a percentage of, again depending on the type of contract you took out.

If you know you are going to need an operation, it would be advisable to join a mutuelle beforehand. You should also check if you need to have been with your mutuelle for a certain number of months before you can access all services. For example, for women intending to get pregnant, some mutuelles require you to be a member for at least 9 months before you can benefit from any maternity coverage.

Many mutuelles cover complementary health services such as osteopathy and physiotherapy, and some also cover herbal medicine and more alternative services, although these tend to be in the minority and may mean you pay higher prices for cover.

The main thing to remember is that the medical professional you visit needs to be validated by the state, meaning the provider has the Diplome d’Etat and therefore is part of the recognised traditional medical system. Medicine in France is rather traditional, with little use of the more contemporary methods used in the other countries, and the mutuelle reimbursements reflect this. You can find out which professionals and establishments are covered by searching on Ameli.

One area that is substantially better than the UK, for example, is being covered for fertility treatment. If you do this in a public hospital like Cochin (in Paris), the whole procedure is free with the help of your mutuelle. However, if you choose a private fertility clinic, you will pay around €60 per meeting, which is not covered by mutuelles.

Mutuelle Reimbursements: Should You Take Out 100%, 150%, or 200% Cover?

Most mutuelles offer at least three different ‘levels’ of coverage, with the first level providing a ‘base’ level or ‘100%’ coverage, and the other levels providing ‘150%’, ‘200%’, or even higher coverage. Some mutuelles offer up to eight different levels, and each one will be broken down into different percentages or flat rates offered for different services.

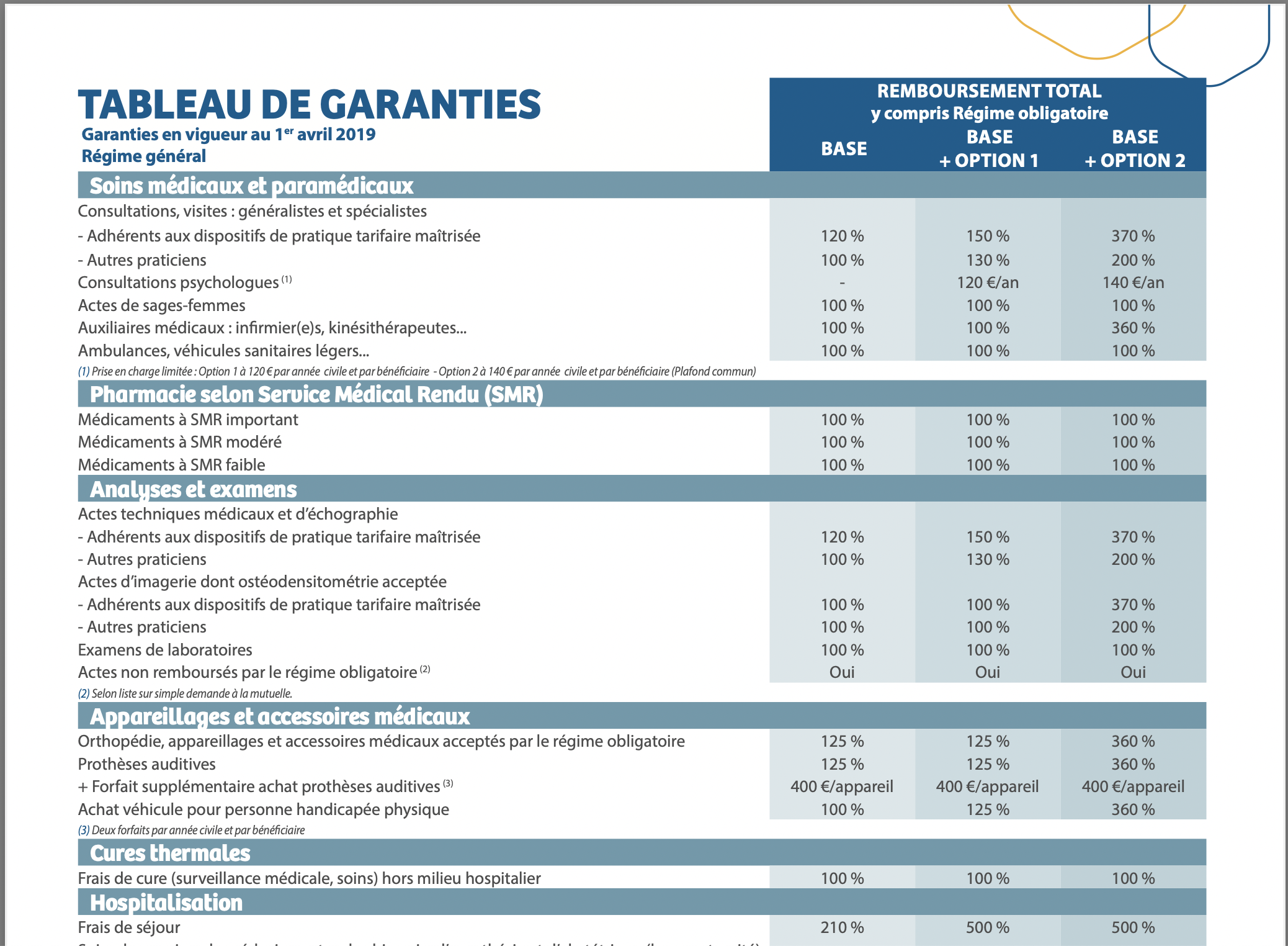

You should be given a table showing the breakdown of coverage offered, such as the example 2019 table from Harmonie Mutuelle below. As you can see, depending on which tariff you choose – Base, Base + Option 1, or Base + Option 2, the mutuelle will pay different percentages for different services. This is typically quite an extensive list, and you may want to pay most attention to areas which concern you – coverage for opticians and glasses, for example, if you wear glasses. You may also find that the 2nd level is not much more expensive than the first, but offers many more advantages.

What is a little more confusing is understanding what these percentages actually mean. ‘100%’ coverage means that your mutuelle will cover 100% of the remaining charges (after the state-paid portion), but this is 100% of the ‘base rate’, which may not be the actual price that you pay. This ‘base rate’ is set by the state, but not all doctors or medical services adhere to this base rate.

For example, the base rate could be set at €100, but your chosen practitioner charges €130. Let’s say that 70% is covered by the state, and you have 100% coverage with your mutuelle. That means €70 is paid for by the state, and your mutuelle will cover the rest of the base rate, paying €30 to bring you to a total of €100. You would then still need to pay the remaining €30. However, if you have 200% coverage, your mutuelle would reimburse the entire €60 difference.

It’s reassuring to know that for most medical professions, there are limits to how much a practitioner can charge over the base rate, and taking out a 150% coverage is likely to be sufficient for most services. However, some areas, such as dentistry, ophthalmology, or mental health services, may be more expensive, and additional coverage might be a good idea. Again, it’s important to discuss your specific needs with your healthcare insurer and ensure you understand which areas you may need more coverage.

Everything You Need to Know About Healthcare in France

From understanding the French state healthcare system and visiting a doctor to choosing a mutuelle insurance and dealing with your and your family’s health concerns—FrenchEntrée is here to help. Follow our Essential Reading articles for everything you need to know about healthcare in France.

Share to: Facebook Twitter LinkedIn Email