French Income Tax Bands in 2025: How Much Tax Will You Pay?

Essential Reading

Income tax thresholds have increased this year – here are the new tax band thresholds that will apply to your 2024 income declared on your 2025 tax return.

What is the French income tax scale for 2025?

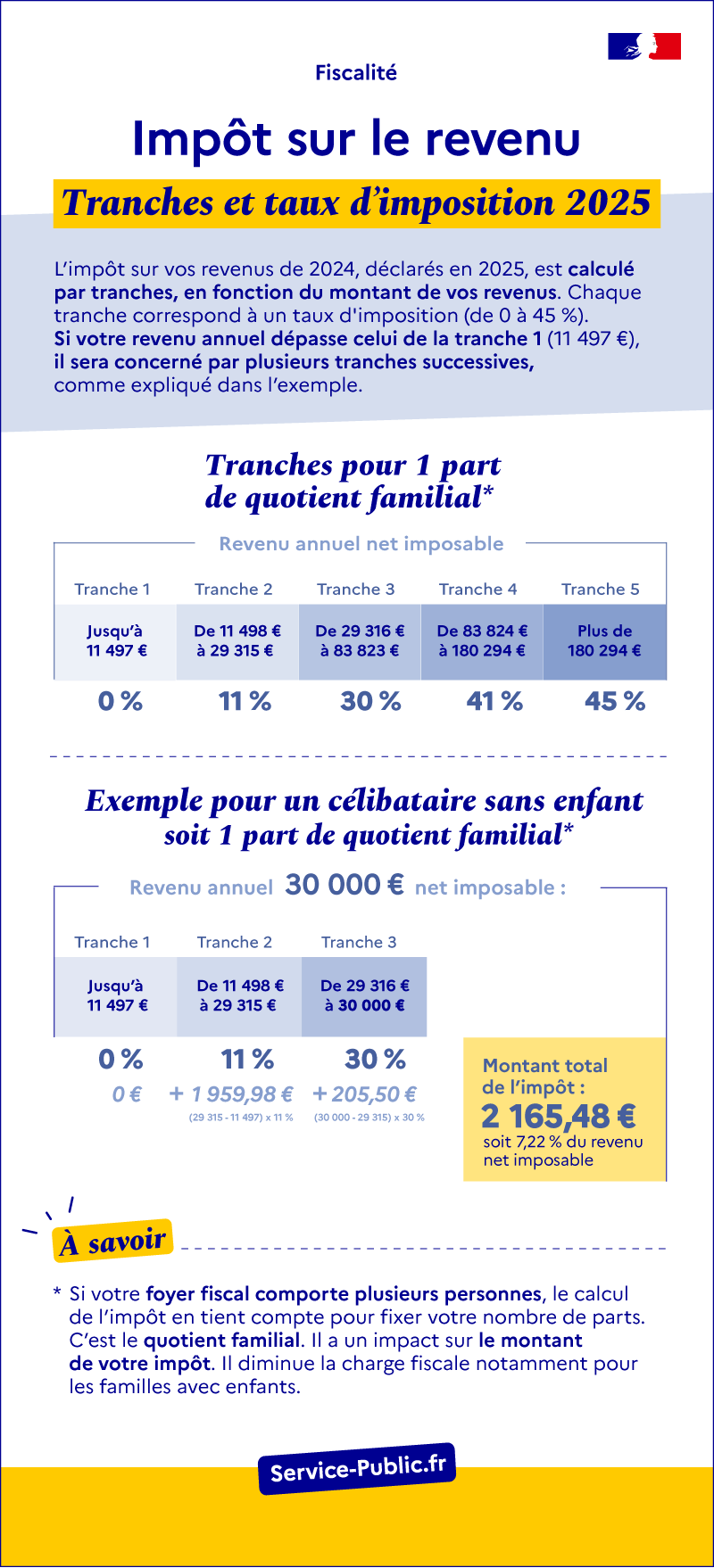

The country’s progressive tax scale bands for 2025 are now as follows:

Per household unit (for more on this, see our guide Understanding French Tax- What is a Fiscal Household in France?)

- Up to €11,497: 0% tax rate

- From €11,498 to €29,315: 11% tax rate

- From €29,316 to €83,823: 30% tax rate

- From €83,824 to €189,294: 41% tax rate

- More than €189,294: 45% tax rate

How much tax will you pay in France in 2025?

It’s important to note that the tax rates themselves have not changed; however, the higher tax scale thresholds should mean that households will pay less income tax overall.

These tax savings will be applied to your 2025 French income tax return, which concerns tax levied on your 2024 income.

There will also be no changes to the social charges/social contributions rates in 2025.

How much will you pay in 2025?

The following examples were taken from the French government website here and show the potential income tax payment for a typical salaried worker in France (remember that this is just an example and will vary depending on your fiscal household, tax credits and reductions, etc.).

2025 rates (levied on income from 2024)

For a single person (1 part) whose taxable net annual income is €30,000, the calculation of their tax was as follows:

– Up to €11,497 (band 1): €0

– From €11,498 to €29,315 (band 2): €1, 959.98

– From €25,711 to €30,000 (band 3): €205.50

Total amount of tax: €2,165.48, or 7.22% of their taxable net income.

Paying Your Taxes in France

Whether you are moving to France, own French property, or have business interests, assets, or investments in France—FrenchEntrée is here to help with all your tax questions. Our Essential Reading articles are designed to give you an overview of the basics, from income tax and social charges to wealth tax and property taxes. However, tax laws and rates are always subject to change, and international tax liabilities can be especially complicated, so if in doubt, we always advise discussing your personal situation with one of our recommended financial or tax advisors.

Disclaimer: This guide is provided for general information purposes only and is not intended to be a substitute for professional advice regarding any aspect of your tax planning or tax liabilities in France. FrenchEntrée cannot be held responsible for the consequences of decisions or actions you may choose to take in connection with French tax declarations or tax liabilities.

Share to: Facebook Twitter LinkedIn Email

By FrenchEntrée

Leave a reply

Your email address will not be published. Required fields are marked *

REPLY

REPLY